Beyond the Price Tag: The Hidden Costs of 'Cheap' Solar Street Lights from China

- coco wang

- 2025年8月28日

- 讀畢需時 8 分鐘

Introduction: The Strategic Dilemma of an "Irresistible" Quotation

As a project manager, you have two quotes for a solar street light project on your desk. Quote A is shockingly low, a figure that promises to bring your project in well under budget and perhaps even secure a performance bonus. Quote B, from another manufacturer, is nearly 80% higher; it seems uncompetitive, almost unreasonable. The temptation is immense: select Quote A, lock in the savings, and demonstrate exceptional cost control to senior management.

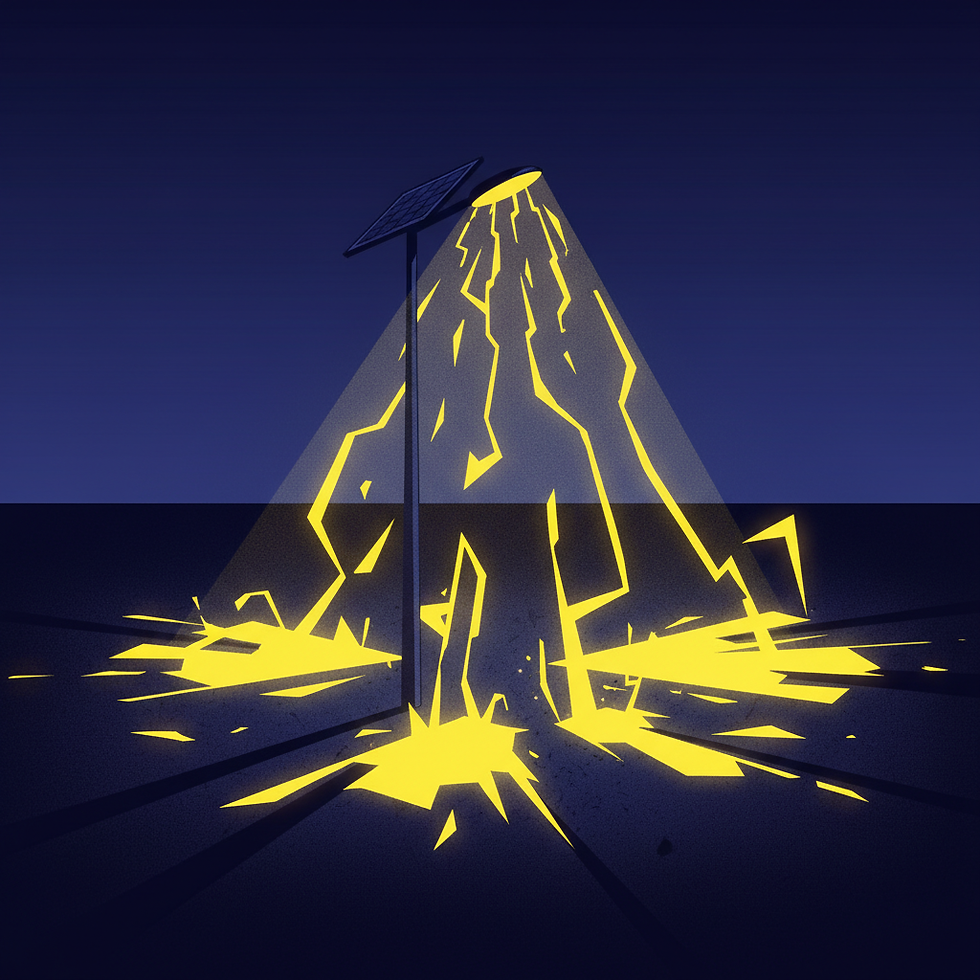

However, in the highly technical domain of solar lighting—a world governed by materials science, power electronics, and precision engineering—every seasoned professional understands a brutal truth: a price that seems too good to be true almost invariably conceals a long-term cost that is too high to bear. Basing a procurement decision primarily on the initial price tag is not a savvy financial move; it is a strategic blunder that plants a ticking time bomb at the foundation of your project. It is the single most common pathway to project failure, budget overruns, and reputational damage.

This article moves beyond simple warnings. We will conduct a forensic analysis of the "low-cost" model, dissecting the hidden compromises that lurk beneath an attractive price. We will demonstrate why professional B2B buyers must evolve beyond simplistic price comparisons and adopt a more sophisticated framework based on Total Cost of Ownership (TCO), ensuring every procurement decision is a sound investment in the long-term success of their project.

The Anatomy of "Cheap": A Forensic Deconstruction of Components

An extremely low price is the direct result of a ruthless compression of costs. In manufacturing, this is not achieved through innovation, but through sacrifice—sacrificing the performance, reliability, and safety that should have been built into your product. Let's perform a reverse-engineering exercise and expose where, precisely, the value has been cut.

The "Heart" Condition: Battery Capacity Fraud and Lifespan Traps

The battery is the "heart" and energy storehouse of an off-grid solar system. Its performance dictates the project's success or failure, making it the primary target for cost-cutting.

Capacity Fraud – The Acceptance Test Time Bomb: A battery labeled "100Ah" may, through the use of inferior cells and manipulated software, have a true usable capacity of only 60Ah. From a project management perspective, this means it will categorically fail any contractually stipulated test for "3-day autonomy" during consecutive rainy days. This leads directly to a failed acceptance test, frozen payments, and potentially liquidated damages for project delays, trapping you in a cycle of rework and disputes.

The Lifespan Trap – The Unbudgeted Catastrophe: Quality solar lights use new, Grade-A LiFePO4 cells from top-tier manufacturers, offering over 3,000 deep cycles. Low-cost alternatives routinely use second-life or recycled cells from electric vehicles, which may have a cycle life of less than 800. This means a light designed to operate for 5-7 years may suffer catastrophic battery failure in under two. You are then faced with a disastrous scenario: requesting a massive, unbudgeted capital expenditure to replace the entire fleet of batteries, a cost that will likely exceed the initial "savings."

The "Engine" Deception: Solar Panel Efficiency and Material Downgrades

The solar panel is the system's sole "engine." Its real-world efficiency dictates whether the system can generate enough power, especially under adverse conditions.

Power & Efficiency Lies: Under-speccing is rampant—labeling an 80W panel as 120W or using low-grade, cracked solar cells with conversion efficiencies far below the industry standard of 22%+. For projects in Northern Europe, Canada, or regions with cloudy winters, this is a fatal design flaw. The system will consistently be undercharged, placing chronic stress on the battery and leading to its premature death.

The Compromised "Brain" and "Eyes": Controller & LED Performance

The controller is the "brain," and the LEDs are the "eyes" that deliver the final result.

The Inefficient Brain: Low-cost products use outdated PWM (Pulse Width Modulation) controllers instead of modern MPPT (Maximum Power Point Tracking) technology. An MPPT controller is 15-30% more efficient. From a project manager's viewpoint, choosing PWM means you are effectively throwing away 15-30% of the free solar energy your system collects, every single day. It's an unacceptable waste baked into the design.

The Dimming Eyes: To cut costs, cheap lights use low-efficacy LEDs (<120 lm/W). To appear bright, they must be driven at a higher wattage. This creates a vicious cycle: higher power drain stresses the already undersized battery, while the excess heat generated causes rapid lumen depreciation. Your project may look great upon installation, but within a year, residents will complain about dimming lights, leading to warranty disputes and failure to meet municipal lighting standards.

The Brittle "Armor": Structural and Material FrailtiesThe luminaire housing is the "armor" protecting the critical components. Low-cost products use thinner, recycled aluminum. This isn't an aesthetic issue; it's a safety issue. From a project risk perspective, this means the product's wind load rating is likely falsified. In a hurricane or severe storm, this can lead to catastrophic failure—fixtures being torn from poles, causing property damage and public injury. The resulting liability will be thousands of times greater than the initial cost savings.

A Project Manager's Math: Deconstructing the Total Cost of Ownership (TCO)

As professional decision-makers, our objective is not to buy the cheapest product, but to procure the asset with the lowest total cost over its entire operational life. Let's set aside the tempting initial quote and use a project manager's framework to calculate the real numbers.

The logic of Total Cost of Ownership (TCO) can be summarized by a simple formula:

TCO (5-Year) = Initial Purchase Cost + (Annual O&M Costs × 5) + Cyclical Replacement Costs

Let's apply this formula to a 100-unit project, comparing our two scenarios.

Scenario A: The "Low-Bid" Product (@ $150/unit)

Initial Purchase Cost:100 units × $150/unit = $15,000This number looks fantastic on the initial budget report and is easy to get approved.

Operating & Maintenance (O&M) Costs:Given the inferior components, a high failure rate is predictable. Let's conservatively estimate that 20% of the lights will require a maintenance intervention (a "truck roll" with a technician) each year.Annual O&M Cost = (20 interventions/year) × ($200/intervention) = $4,000/yearTotal 5-Year O&M Cost = $4,000 × 5 = $20,000

Cyclical Replacement Costs:This is the financial killer. The low-grade batteries will need a full-fleet replacement, which must be planned for the end of Year 3.Battery Replacement Cost (Year 3) = 100 units × ($75/unit for battery + labor) = $7,500

Scenario A - 5-Year Total Cost of Ownership:TCO_A = $15,000 (Purchase) + $20,000 (O&M) + $7,500 (Replacement) = $42,500

Scenario B: The "Value-Engineered" Product (@ $270/unit)

Initial Purchase Cost:100 units × $270/unit = $27,000This higher initial investment requires justification, which our TCO analysis will provide.

Operating & Maintenance (O&M) Costs:High-quality products are highly reliable. We can project a very low failure rate, perhaps requiring 2-3 interventions per year across the entire fleet.Annual O&M Cost = (3 interventions/year) × ($200/intervention) = $600/yearTotal 5-Year O&M Cost = $600 × 5 = $3,000

Cyclical Replacement Costs:The system uses top-tier, Grade-A cells designed for a lifespan well beyond 5 years. No replacement is needed within our TCO calculation period.Battery Replacement Cost (within 5 years) = $0

Scenario B - 5-Year Total Cost of Ownership:TCO_B = $27,000 (Purchase) + $3,000 (O&M) + $0 (Replacement) = $30,000

The TCO Verdict:The results are staggering.

Scenario A, the "cheap" option, is actually 40% more expensive over the project's first five years. This calculation provides the undeniable, data-driven justification needed to defend the higher initial investment. It transforms the conversation from "Why is B so expensive?" to "Why is A so high-risk and costly in the long run?"

Hallmarks of a Quality Manufacturer: The Quality Signals You Must Demand

To navigate the market, you must act like a forensic investigator, demanding specific evidence to differentiate a mere "assembler" from a genuine, quality-focused "manufacturer."

Component Transparency: Demand the "Birth Certificate"

A professional manufacturer is proud of its supply chain. You must demand a detailed Bill of Materials (BOM) that specifies:

Battery Cells: Are they new, Grade-A LiFePO4 cells from top-tier brands like CATL, EVE, or Gotion? Demand the cell's original specification sheet.

LED Chips & Driver: Are they from reputable brands like Bridgelux, Cree, or Lumileds? Ask for the LM-80 report, which provides data on lumen depreciation.

Controller Type: Insist on confirmation that it is an MPPT controller and request its technical datasheet, including conversion efficiency.

The Weight of Certifications: More Than Just Paper

Demand full, valid, and verifiable third-party test reports. They are your shield against non-compliance and liability.

Baseline Certifications (CE, RoHS): These are the minimum entry requirements for markets like Europe, ensuring basic safety and environmental compliance.

Advanced Certifications (CB, ENEC): A CB certificate demonstrates compliance with international safety standards, facilitating global market access. ENEC is a high-level European mark that signifies rigorous product testing and annual factory inspections.

Performance Reports (IP, IK, Salt Spray): Do not accept a simple "IP66" claim on a brochure. Demand the full test report from an accredited lab like TÜV, SGS, or Intertek. For coastal projects, a salt spray test report is non-negotiable.

Beyond Assembly: Inspect the Manufacturer's "DNA"

A true manufacturer invests in its own capabilities.

In-House R&D and Testing: Do they have an engineering team? Do they own critical testing equipment like an integrating sphere (for light measurement), climatic chambers (for temperature/humidity testing), and battery cell cyclers?

Manufacturing Processes & Quality Systems: Ask for a virtual factory tour. Look for evidence of automated SMT lines for electronics, a rigorous 72-hour aging test process for finished goods, and an ISO9001 quality management system certification. These are the hallmarks of consistent, reliable production.

Red Flags in the Procurement Process

During your interactions with potential suppliers, be alert for these warning signs. They are early indicators of future problems.

Vague or Incomplete Datasheets: A professional datasheet is a binding technical commitment. If it lacks critical data like luminaire efficacy (lm/W), battery cycle life curves, or specific component brands, it is a deliberate act of "strategic ambiguity" designed to allow for the substitution of cheaper parts.

Refusal to Provide Third-Party Reports: If a supplier claims that test reports are "confidential" or is evasive when you request them, it is the biggest red flag. A manufacturer who has invested in quality testing is eager to show you the results.

A Singular Focus on Price Over Value: When the salesperson's entire conversation revolves around being the "cheapest" and they cannot intelligently discuss how their product's features solve your project's specific challenges, it signals that the entire company culture is built on price, not performance.

Lack of Professional Project Support: A true partner can understand your project parameters (road width, pole height, local solar insolation) and offer intelligent configuration advice. If a supplier is only interested in your order quantity, they will be of no help when technical problems arise post-installation.

Conclusion: A Strategic Shift from "Price-First" to "Value-Driven"

Procuring solar street lights from China is not a simple shopping exercise; it is a complex, strategic investment decision. The most painful lesson learned by experienced professionals worldwide is this: in infrastructure, the most expensive product is often the one that was cheapest to buy.

To ensure your investment delivers reliable, effective illumination for years to come, you must execute a critical upgrade in your procurement mindset:

From Scrutinizing Price to Scrutinizing Components: Understand the heart, engine, and brain of the product you are buying.

From Reading an Invoice to Calculating TCO: Adopt a CFO's perspective to understand the true, long-term financial impact of your decision.

From Trusting a Brochure to Verifying with Evidence: Act like a quality engineer and demand the data—certifications, test reports, and technical files.

When you begin to evaluate suppliers through this value-driven lens, you not only insulate your project from the catastrophic risks of the "low-price trap," but you also identify the true manufacturing partners who will contribute to your project's lasting success.

Ready to Make a Truly Smart Investment for Your Project?

Move past the fog of price and let's focus on performance and value. Contact the expert team at Novafuture Tech (nfsolar) for an in-depth project consultation or product inquiry. We use professional data and transparent communication to help you build a solar lighting solution that is stable, efficient, and truly cost-effective.

Website: www.nfsolar.net

Email: cocowang@novafuture.net

WhatsApp: +8613013537907

留言